As an employer, keeping up with the payroll facilities of the employees is extremely confusing. Not only do you have to be mindful of all your financial services, but you also have to keep up with all the accounting needs of the employees.

RapidFS is an online financial service that enables employees to streamline electronic payroll to their employees without staying connected to traditional or standard banking solutions. It enables both the employers and the employees to have a safer financial operation because their solutions are backed by Visa and Mastercard’s zero liability programs.

If you are an employer looking for better payroll management systems for your employees, let us walk you through the basics of RapidFS and why it is one of the best in the market.

Who can benefit from the RapidFS Card?

If you are an employee who is looking for a unified payroll management system to manage your payslips, easily cash the cheques, etc, RapidFS Card can benefit you in multiple ways.

To further streamline the understanding, the RapidFS card can benefit employees, including:

- Working on temporary visa approval in the United States

- Don’t have a traditional checking account

- Want to keep track of the budget and expenses

- Make payments using cash even with having a savings account

- Use a merchant prepaid card that charges monthly fees

Using RapidFS’ PayCard, the employees will no longer have to wait for their monthly payment and go through the hassle of receiving their salaries.

What are the Benefits of RapidFS?

Now that you know who would benefit from the RapidFS card, let us walk you through the list of all the benefits that users can reap from the card.

Some of the most pivotal ones include:

- Get rid of the higher cashing fees

- Streamline direct deposit of the salary to the card

- Easy management of payments from multiple sources

- Free access to all the deposited payments

- Easy shopping access with Visa functionalities

- Support budget control to prevent overspending

- Direct access to Allpoint® ATMs without hidden or additional charges

- Easy replacement for any lost or stolen cards

- Easy online payment of the bills

- Manage the account and payments via the online website

These are some of the basic and highlighted features of the RapidFS card. The list is evolving as they are further improving and streamlining its features and services.

What are the Login Features Available on the RapidFS card?

With the RapidFS card, users can:

- Manage their account and check their account balance

- Keep track of the transactions and account statement

- Pay bills online

- Get direct alerts via SMS and push notifications

- Have easy access to flight and hotel accommodations

- Subscribe to the available savings plan via the platform

- Have access to the direct deposit function with the employer

All of these features and services can be accessed by the user once they activate their RapidFS card.

What are the steps involved in activating the RapidFS Card?

For activating the RapidFSPayCard, there’s not much that you have to do. The steps are simple. All you need to do is ensure that you follow all the steps mentioned down below:

Remember that users can’t accept or process any kinds of payments until the card is activated. So, that’s your first step. Also, when you are activating your card, there is a separate option where you can get a replacement card with your name embossed on it.

Once you have initiated the activation process or ordered the replacement card, it should reach you within 7-10 days, depending on your location.

Upon receiving your card, you have to get in touch with ‘RapidFS’ customer care at 1-877-380-0980. If you want to do it entirely on your own, you can do so by visiting their official website at https://www.rapidfs.com/.

How can one Access their Cardholder Account?

Once you have activated your RapidFS card and you are using it daily, keeping track of the payment deposits and the overall expenses is crucial. You want to ensure that you have access to the detailed account history so that if something seems out of the blue, you can take immediate action.

Here’s how you can access and manage your account online:

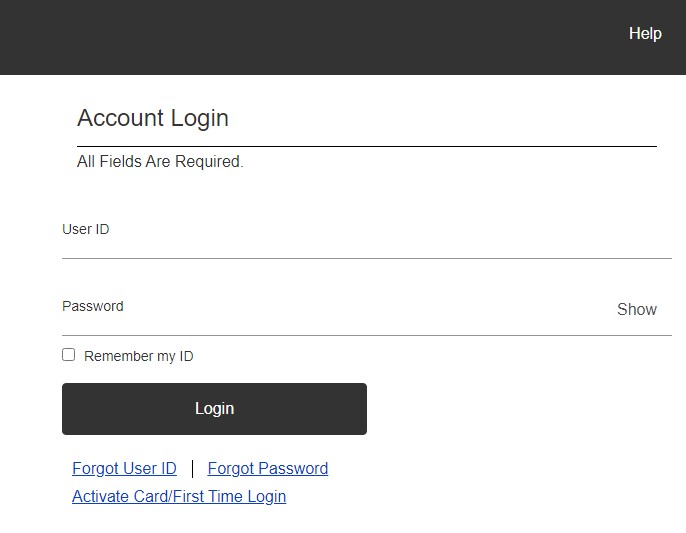

- You have to open https://www.rapidfs.com/ from your browser and then navigate to the company’s official website from there.

- Under that, the users have to enter their nickname or account number, followed by the password in the designated fields.

- Once you verify the entered details, you can then go ahead and click on Login to enter the portal and use it according to your needs.

Ideally, in case you forget your username or your password, we’d recommend recovering those with the on-screen instructions that are displayed on the website.

What are some of the Convenient Functions of the RapidFS card?

Now that you have all the basics sorted, some of the most standout features of the RapidFS card include:

- Updates about every deposit using the free SMS notification

- Direct access to cashback rewards

- Integrated free savings account

- Enables easy payment of bills online

You can easily access a lot more functionalities the more you use the card for all your monthly budgeting and daily expenses.

If you were looking for a payment card that makes payroll management simpler, reliable, and hassle-free, the RapidFS card is no doubt one of the absolute best in the lot. We’d recommend you know more about the same to get a better idea of the features, benefits, and the involved functionalities that come with the card.

FAQs

How do I check my RapidFS account balance?

If you don’t have SMS notifications switched on, you can text “BAL” to 90831 from your phone to get the message with your account balance.

How many cashback rewards can I get?

The cashback rewards with the RapidFS card are pretty amazing. However, the degree of availability depends on the transactions involved.

Is the RapidFS card safe to use?

Yes, the RapidFS card is not just safe to use, it is also a quite hassle-free and unified platform for all your monthly budgeting needs.